Will a new record follow Friday’s rebound?

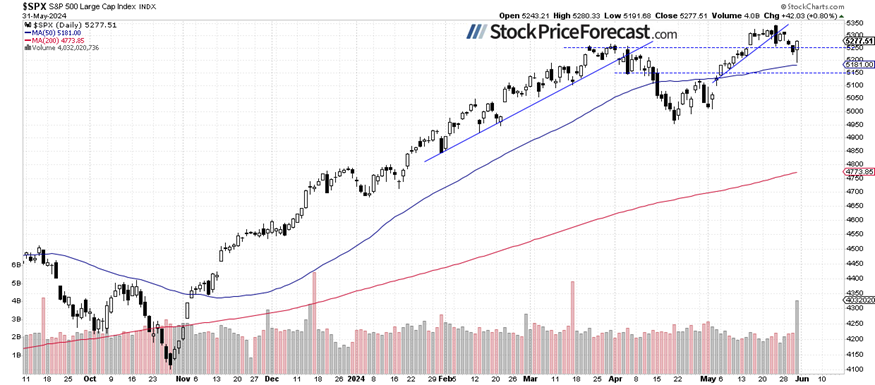

Friday’s trading session brought a sharp upward reversal, with the S&P 500 index closing 0.80% higher and gaining almost 90 points from its daily low of around 5,192. The market turned higher as investor sentiment improved following a lower-than-expected Core PCE Price Index release and the usual volatility amid the last day of the month, a ‘window dressing’ price action.

Stock prices bounced from their new local low, and the index got back above the crucial 5,250 level again. So, was it a reversal ending the downward correction? The market may see more uncertainty ahead of a series of economic data this week. The most likely scenario is more consolidation and sideways trading.

This morning, the S&P 500 index is likely to open 0.4% higher, as indicated by futures contracts, as investor sentiment remains elevated following Friday’s rebound.

Investor sentiment worsened, as indicated by the AAII Investor Sentiment Survey last Wednesday, which showed that 39.0% of individual investors are bullish (a decrease from last week’s reading of 47.0%), while 26.7% of them are bearish. The AAII sentiment is a contrary indicator in the sense that highly bullish readings may suggest excessive complacency and a lack of fear in the market. Conversely, bearish readings are favorable for market upturns.

The S&P 500 bounced from the 5,200 level on Friday, as we can see on the daily chart.

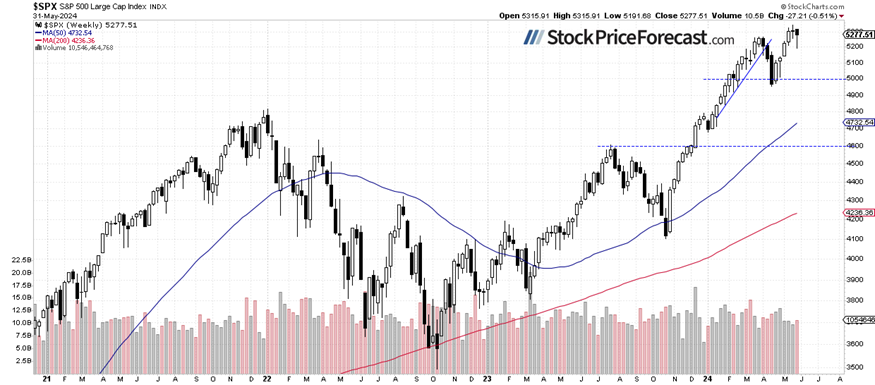

SP 500: Weekly indecision

Compared to the previous Friday’s closing price, the index lost 0.51%. Last week, it gained just 0.03%, so, the market is basically going sideways.

Quoting an article from May 13: “The recent price action confirmed the importance of the 5,000 level as a medium-term support. It’s hard to say whether the market will continue its long-term uptrend; however, it will most likely remain above 5,000 in the coming weeks or months.”

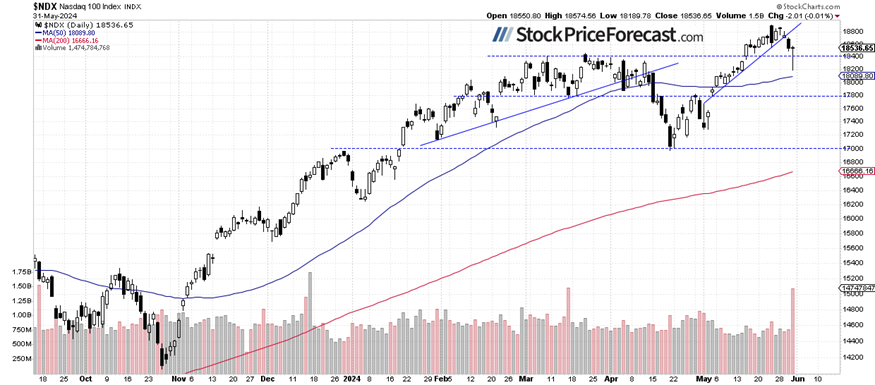

Nasdaq 100 – Clear short-term upward reversal

On May 23, the technology-focused Nasdaq 100 index reached a new record high of 18,907.54, and last Friday, it was as low as 18,189.78, which means a 3.8% downward correction in a little more than a week. Was it enough to spur another record-breaking rally? It’s hard to say – the market may see more uncertainty this week. However, this morning, the Nasdaq 100 is likely to open 0.7% higher.

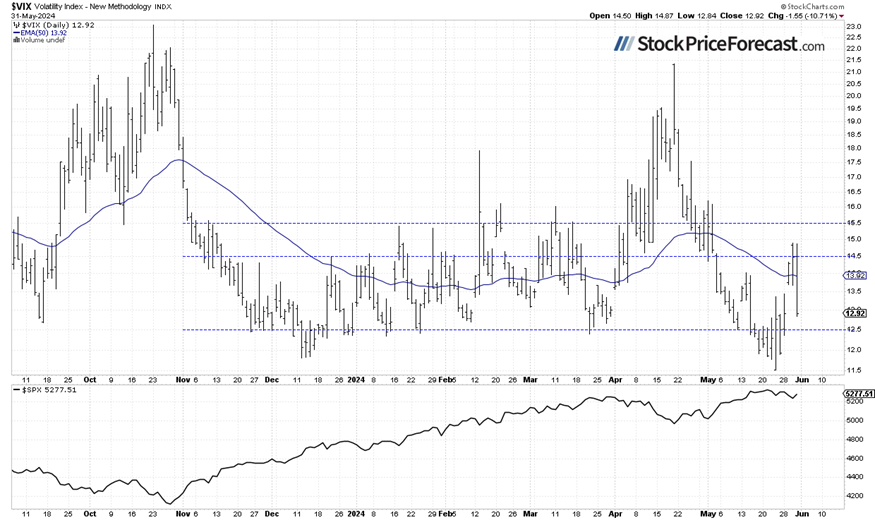

VIX – Below 13 again

The VIX index, also known as the fear gauge, is derived from option prices. In late March, it was trading around the 13 level. However, market volatility led to an increase in the VIX, and on April 19, it reached a local high of 21.4 – the highest since late October, signaling fear in the market.

Recently, it was declining again, and on May 23, it reached its lowest point since November 2019 at 11.52. Last week, the VIX had been gaining, reaching almost 15 on Thursday and Friday. However, on Friday, it closed below the 13 level.

Historically, a dropping VIX indicates less fear in the market, and rising VIX accompanies stock market downturns. However, the lower the VIX, the higher the probability of the market’s downward reversal.

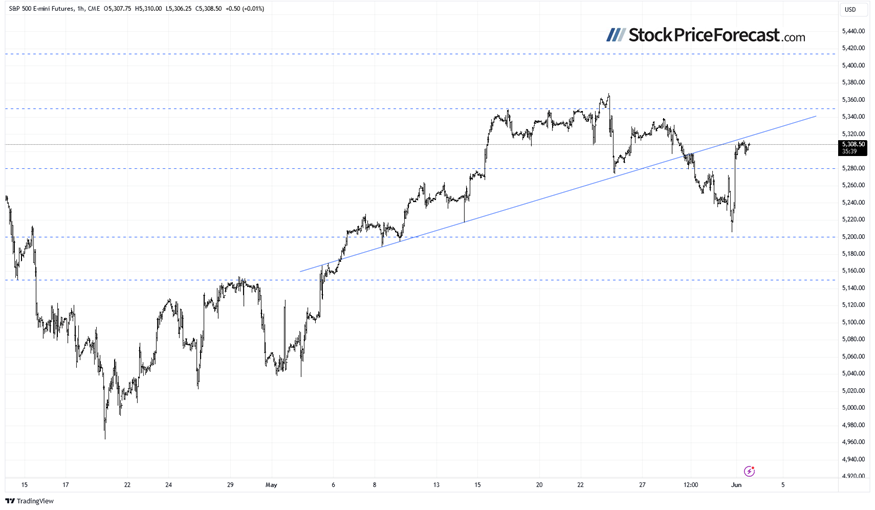

Futures contract trading above 5,300

Let’s take a look at the hourly chart of the S&P 500 futures contract. On previous Thursday, it pulled back from a new record high of around 5,368 and fell by almost 100 points, before rebounding up to around 5,340. Since then, it has been consistently declining, reaching a low of around 5,206 on Friday. However, it rebounded and broke above 5,300 again. The resistance level is at 5,330-5,340, among others.

Conclusion

The S&P 500 index is expected to open higher, slightly extending its intraday rebound from Friday, as investor sentiment remains elevated ahead of a series of economic data releases. The market may see more short-term uncertainty, but a deeper correction now seems less likely.

Yesterday, I wrote “It’s hard to tell if the recent price action was just a flat correction of the uptrend or a topping pattern before a downward reversal. For now, it looks like another potential profit-taking action following recent record-breaking advances. However, a decisive breakdown of the 5,250 support level, which was marked by local highs from March and April, would likely lead to a deeper correction of the advance from the early May local lows.”

So, the market was, in fact, experiencing a slightly deeper correction of the uptrend, with the S&P 500 index dipping below the important 5,250 level. The ‘window dressing’ price action at the end of the day caused a big rebound in stock prices. However, it likely won’t be enough to fuel another record-breaking rally, at least not that soon.

For now, my short-term outlook remains neutral.

Here’s the breakdown:

The S&P 500 is likely to extend its intraday rebound from Friday.

On Friday, stock prices were the lowest since early May, indicating a correction of the recent advances.

In my opinion, the short-term outlook is neutral.

The full version of today’s analysis – today’s Stock Trading Alert – is bigger than what you read above, and it includes the additional analysis of the Apple (AAPL) stock and the current S&P 500 futures contract position. I encourage you to subscribe and read the details today. Stocks Trading Alerts are also a part of our Diamond Package that includes Gold Trading Alerts and Oil Trading Alerts.

Want free follow-ups to the above article and details not available to 99%+ investors? Sign up to our free newsletter today!

Source: https://www.fxstreet.com/news/stocks-will-a-new-record-follow-fridays-rebound-202406031310